Companies Mentioned:

Accel, Apptio, Atlassian Ventures, Bain Capital Ventures, Baird Capital, Bessemer Venture Partners, BetterCloud, Blissfully, Calero, Canaan Partners, Cleanshelf, Cloudability, Coupa Ventures, Craft Ventures, e.ventures, Endiya Partners, Entrée Capital, Flybridge Capital Partners, Founder Collective, F-Prime Capital, Global Founders Capital, Greycroft, High Alpha, Intello, IVP, Kalaari Capital, LeanIX, MassMutual Ventures, Menlo Ventures, New Amsterdam Growth Capital, Norwest Venture Partners, Okta Ventures, Productiv, SailPoint, Scopus Capital, Shine, SoftBank, Sound Ventures, Sozo Ventures, Spring Lake Equity Partners, Tangoe, Tiger Global, Tropic, Uncork Capital, Vendr, Vista Equity Partners, Warburg Pincus, Wing Venture Capital, Y Combinator, Zluri, Zylo

Key Stakeholders:

Chief Information Officers, Chief Technology Officers, Chief Financial Officers, Finance and Accounts Payable Directors and Managers, Procurement Directors, Technology Expense Directors and Managers, FinOps Directors and Managers, IT Architects, Vice President/Director/Manager of IT Operations, Product Managers, IT Sourcing Directors and Managers, IT Procurement Directors and Managers, SaaS Expense Managers, Sales Operations Managers, Marketing Operations Managers.

Why It Matters:

SaaS (Software as a Service) Operations is a hot market where vendors have collectively received over $1 billion in investments. End user organizations are seeking to manage $250 billion in annual spend associated with SaaS subscriptions, which can often be scattered over 1,000 apps in large multi-national enterprises. Even a relatively small 500-person organization can expect to have over 200 apps under management. This combination of vendor sprawl, shadow IT, and governance challenges are quickly forcing businesses to realize that they require SaaS governance across sourcing, spend, access, inventory, and security. With this $20 million Series B round, Zluri enters this fray in earnest in making its automation platform more accessible to the SaaS management market.

Top Takeaway:

Zluri is an Amalgam Insights recommended vendor for automating service orders, managing onboarding and offboarding, monitoring app usage, and managing SaaS spend. It fills multiple core responsibilities within the Amalgam Insights Technology Lifecycle Management relative to SaaS and should be considered by companies seeking to support SaaS environments with over $1 million in total annual spend or with over 100 separate app vendors under management.

Zluri Raises a $20 Million Series B Round

On July 13, 2023, Zluri, a SaaS operations platform, announced a $20 million Series B round headed by Lightspeed with additional participation from existing investors including MassMutual Ventures, Endiya Partners, and Kalaari Capital.

This funding occurs in context of a breadth of investment in managing the operations and procurement of SaaS including the following funding investments and product launches:

- Feb 2023 – Zylo raises a $5 million round on top of a $31 million Series C round in December 2022.

Investors include: Baird Capital, Bessemer Venture Partners, Coupa Ventures, High Alpha, Menlo Ventures, Spring Lake Equity Partners, - November 2022 – Tangoe announces addition of SaaS management to TangoeOne platform

- June 2022 – BetterCloud, a SaaS management firm, sells a majority stake to Vista Equity Partners after raising $187 milion over six rounds.

Previous Investors included: Warburg Pincus, Accel, Bain Capital Ventures, e.ventures, Flybridge Capital Partners, Greycroft, New Amsterdam Growth Capital - June 2022 – Vendr raises $150M Series B to support its SaaS buying platform

Investors include Craft Venturs, SoftBank, Sozo Ventures, F-Prime Capital, Sound Ventures, Tiger Global, Y Combinator - April 2022 – Calero (technology expense management vendor managing over $25 billion in tech spend) announces a SaaS expense management solution

- February 2022 – Vendr acquires Blissfully to add cost management and data offerings.

- February 2022 – Tropic raises $40M Series B from Insight Partners to improve SaaS procurement, a round that occured four months after a Series A round from Canaan Partners, Founder Collective and Shine

- February 2022 – Torii raises a $50M Series B round led by Tiger Global

Investors include Tiger Global, Entree Capital, Global Founders Capital, Scopus Capital, Uncork Capital, and Wing Venture Capital - March 2021 – Enterprise Architcture Management company LeanIX acquires Cleanshelf

- March 2021 – Productiv raises $45M Series C to support SaaS expense management

Investors include IVP, Accel, Atlassian Ventures, Norwest Venture Partners, Okta Ventures - February 2021- SailPoint acquires Intello for $43 million

- November 2020 – Apptio (IT financial management and Cloud FinOps provider) announced Cloudability SaaS for SaaS discovery and spend management

Suffice it to say that the SaaS management market is both a hot market and one that requires both funding and a high quality offering to be competitive. Top tier venture capital and private equity firms have made one or more investments in this space already. But at the same time, one of the concerns that Zluri does not have to worry about is that this market is an actual market. One of the biggest concerns an analyst typically has about a new market is whether it is real or not and backed by customers, revenue, and market competitors. The SaaS Management market has proven this to be true, both in the quantity and quality of offerings in place.

This said, does Zluri match up with the vendors at large and does it have a competitive niche in this complex market?

About Zluri

Amalgam Insights has spoken with Zluri executives multiple times in the past couple of years as we have explored SaaS management and SaaSOps as a part of our overall Technology Lifecycle Management umbrella. In doing so, we have found so far that key differentiating points include:

• Workflow automation to support app discovery and orders

• Activity-based insight into SaaS usage and spending

• Identity management to audit access and automate onboarding and offboarding

As one of the newer SaaS management solutions that Amalgam Insights covers, founded in 2020 in Bangalore, Zluri has a software solution that currently lacks legacy technical debt issues and is built with a current and modern user interface. Amalgam Insights finds it interesting that Zluri was founded in India, as India has traditionally been an area that has supported much of the help desk, service order, invoice processing, and optimization work associated with telecom expense and cloud FinOps work on behalf of US-owned companies. This company represents a shift in seeing Indian entrepreneurs directly owning the company while also being close to a significant center of the technology lifecycle management value chain. This location also means that Zluri has some cost structure advantages compared to most of its competitors started either in the United States or Israel. And its focus on automating SaaS-related processes and workflows provides a strong foundation towards providing not only the operational support to manage SaaS, but also the lineage and t that are needed to trace how and when specific changes were made to a SaaS account.

Zluri’s offering is compelling enough to win business even as it faces the competition listed above. Amalgam Insights estimates that Zluri currently has around 250 customers and over 200 employees, which is in line with the recent funding round that was announced. However, the capital raised in this Series B round is obviously necessary to gain market share in the 100 – 5,000 employee mid-market where Zluri has succeeded to this point. Even in today’s era of product-led growth, some level of market visibility is needed to support go-to-market solutions, especially in a market where Amalgam Insights has tracked total investment that approaches $1 billion.

Amalgam Insights believes that, though Zluri has a competitive and differentiated product that matches up well with current trends in automation and workflow management that will align well with the current megatrend of Generative AI, its biggest challenge is currently in market visibility where the other companies that Amalgam Insights has mentioned have all made inroads with enterprise buyers, channel partners, consultants, and industry associations relevant to the buying cycle of SaaS.

Recommendations to the IT Expense Community

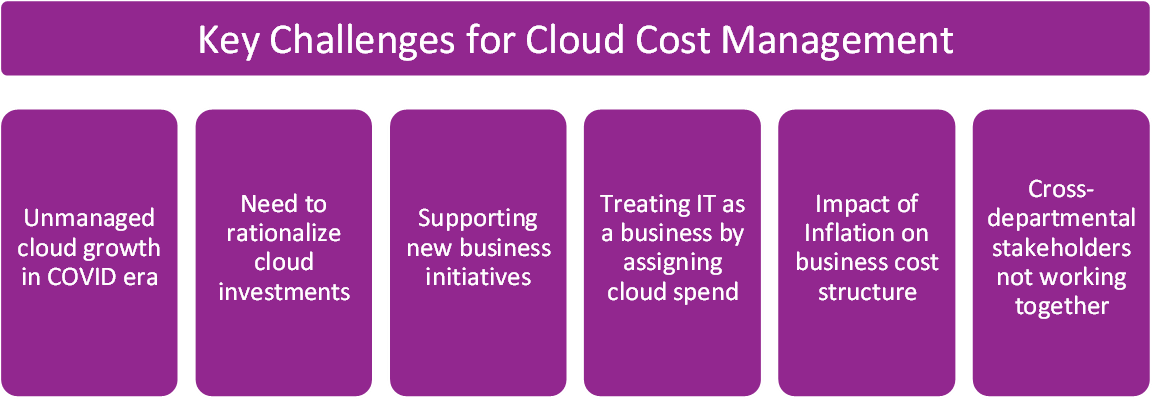

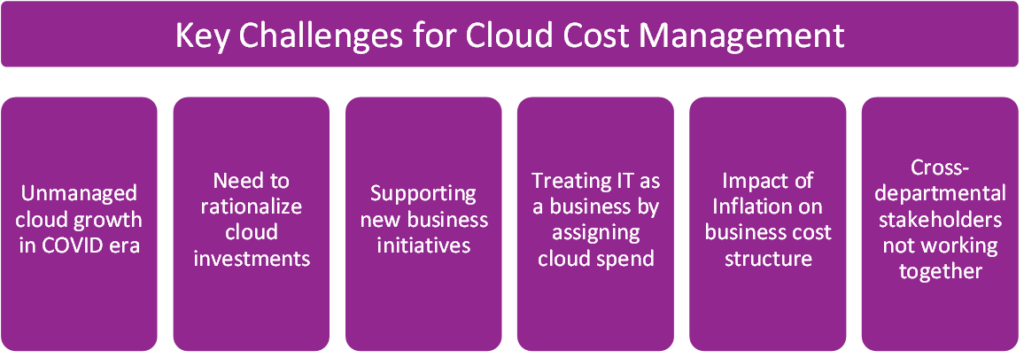

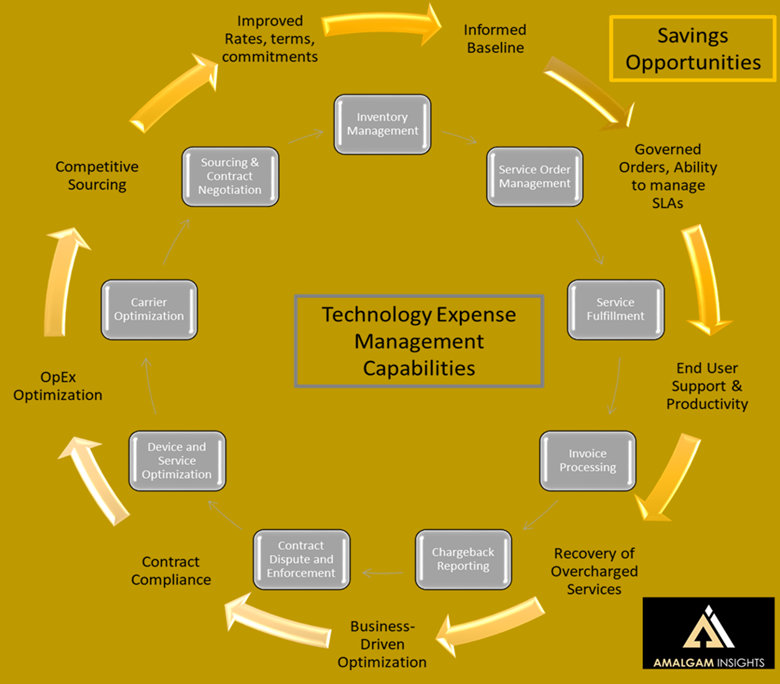

First, in seeking a SaaS management solution, Amalgam Insights always recommends thinking about the full Technology Lifecycle that goes across sourcing, procurement, expense management, vendor management, resource optimization, compliance, and security. SaaS management and SaaS operations are currently fragmented markets where it is hard to find a single vendor that is strong in all of these areas.

Second, in managing this SaaS lifecycle, look for automation and for skill sets that may fall outside of your organization’s core management or sourcing skills. SaaS can be a complicated and complex spend category, especially as large multi-billion dollar enterprises can expect to manage 1,000 apps at this point across both formal and “Bring Your Own” expensed apps that may hide in a corporate credit card or a phone bill.

Third, expect to see Zluri show up more frequently in your due diligence of SaaS management solutions. Amalgam Insights currently recommends Zluri as a solution to manage SaaS costs, support service orders and onboarding through native workflow automation, and to support application discovery, especially in disaggregated environments. And in our research, we have found that Zluri is a solution that wins deals in the majority of competitive evaluations that Amalgam Insights has seen, which indicates alignment with current customer needs. With this funding round, Zluri now is prepared to compete for its fair share of opportunities in a market that is both deep in competitors and in demand from enterprises seeking to control over $200 billion in annual SaaS spend.