The first blog in this series on cloud management and optimization discussed why organizations must make the most of their cloud computing environments – especially as a recession appears likely.

Now, in this second installment, Amalgam Insights analysts lay out the argument in favor of using third-party software, consultancies, and managed services to achieve optimal cloud management status.

We do so knowing that many executives, fearful of a global economic slowdown, might feel tempted to automatically resist the recommendation to bring on another vendor. Thus, we take a step back to paint a picture of the challenges organizations are up against, and share insight, based on collective years of experience, about why paying to manage the cloud environment will, when done right, deliver the greatest value.

Cloud Management and Optimization: It’s About Much More Than Saving Bucks

As a reminder, almost any cloud management and optimization activity can save costs, at least to some extent. That is, of course, useful to any business intent on conserving financial resources. However, more to the point is that cloud management and optimization should lead to more productive, efficient, and deliberate use of cloud computing. After all, cloud supports remote and hybrid workers, as well as strategic corporate initiatives. Therefore, it must deliver. Rarely (if ever, frankly) do organizations get the most out of their cloud environments by trying to monitor and manage cloud resources through spreadsheets or piecemeal efforts.

In other words, Amalgam Insights asserts that it usually makes sense to spend money on the well-chosen cloud management and optimization tools — tools that support revenue-generating initiatives, whether directly or indirectly. The adage, “Spend money to make money,” rings true here as companies seek to eliminate duplicate resources, select the right storage and compute options for data and workloads, and tweak environments so they perform at their best.

The third-party platforms to which we refer support cloud environments at scale. They remove dependence on ungovernable, internally created spreadsheets, on hastily created Git pages with inconsistent documentation standards, and on disparate notes.

Yet, before teaming with a cloud cost management and optimization software, or a professional or managed services provider, it is vital to understand the challenges all organizations share, as well as those that are more specialized, which may require a more custom approach. After considering all the guidance in Amalgam Insights’ 2022 report, Control Your Cloud: Selecting Cloud Cost Management in the Face of Recession, IT, finance, and data leaders should find themselves well-equipped to identify and choose among the options. (Any enterprise executives in search of independent assistance are invited to arrange a consultation with Amalgam Insights analysts. )

The Enterprise Challenges Addressed By Cloud Management and Optimization

Regardless of size, organizations relying on cloud computing face a variety of challenges, especially in the wake of COVID-19-fueled rollouts. Recall that the pandemic in early 2020 forced most businesses worldwide to increase adoption of cloud computing — whether infrastructure, platform, and/or applications — so they could remain operational amid lockdowns and economic upheaval.

The sudden flurry of deployments often was messy; IT personnel quickly spliced together cloud solutions to keep employees connected so they could work remotely. In most cases, there was little or no time to think about how many cloud environments were running.

Then, as enterprises shifted from full-on crisis to figuring out the New Normal of worker expectations, organizations generally did not pause to assess the state of their cloud environments. This typically came down to a lack of awareness or internal skills.

At the same time, the pandemic created a staff and skills shortage that continues into 2022 and will extend beyond 2023. As an example, a recent Korn Ferry study indicates that, by 2030, the world will experience a human talent shortage of more than 85 million people. The staffing challenge is real. When it comes to evaluating and managing cloud environments, there are simply fewer IT experts available to conduct this work for their employers.

Despite the skills shortage, finance executives have grown more aware of looking into and trying to track cloud computing expenses. Still, this presents another hangup for enterprises that do not manage their cloud estates. The finance department lacks the granularity of data that will deliver the reports and insights needed. These leaders need the information that supports asking the right questions of the IT department about cloud computing outlay — and that helps them allocate charges among business units. Simply put, most organizations do not have usable visibility into their cloud environments.

Assessing Cloud Governance, Security, and Provisioning

Alongside the previous challenge lie two more — an absence of governance and security. Organizations that do not properly manage their cloud computing environments risk running afoul of their own policies, not to mention possibly those of various governments. Many organizations also are enacting environmental and sustainability initiatives. A number of cloud cost management and optimization platforms now support those efforts; spreadsheets cannot.

In addition, speaking to security, cyber threats gain even more traction within unmanaged cloud environments. While responsible cloud stewardship does not guarantee insulation against hacks, an absence of said stewardship almost certainly guarantees a breach.

Finally, many organizations are operating in over-provisioned cloud environments due to a variety of situations — say, employee demands for certain applications, an enterprise’s regional or global footprint, and idle resources.

All of the factors combined make for a perfect storm where the organization overpays even as it jeopardizes governance, security, and budget.

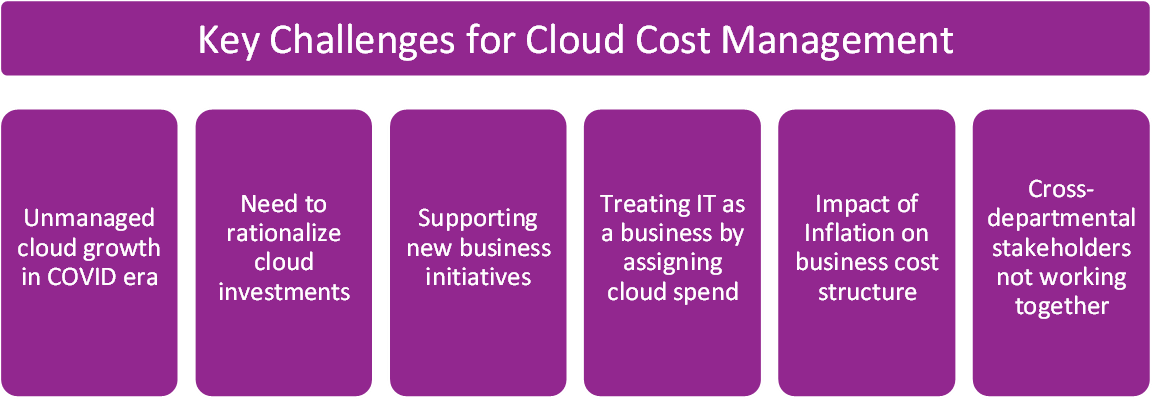

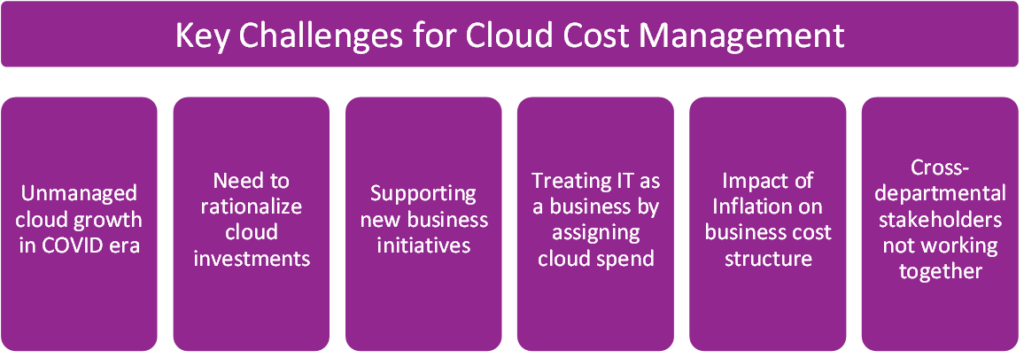

To sum up, enterprises are up against the following cloud computing challenges (see Figure 1):

Figure 1: Key Challenges for Managing Cloud Computing

Yet organizations can — and, Amalgam Insights contends, must — take steps to overcome these circumstances. And with global recession fears mounting, the impetus to do so comes as more pressing than ever.

In the third blog in this series, Amalgam Insights will go deep into the value organizations stand to gain by partnering with a proven cloud management and optimization provider.

Need More Guidance Now?

Check out Amalgam Insights’ new Vendor SmartList report, Control Your Cloud: Selecting Cloud Cost Management in the Face of Recession, available for instant download.