The Big Takeaway: Cloud computing spending has reached new heights. Organizations need guidance to avoid wasting money. The “Control Your Cloud” SmartList will provide guidance for enterprises struggling to manage cloud costs.

Amalgam Insights forecasts that global spending on public cloud computing — including infrastructure and software — will total more than $350 billion in 2022. Driven by the ongoing COVID-19 pandemic and concurrent digital transformation projects, organizations will continue to invest in the cloud, to the tune of more than 20% this year. And the greater the investment made in cloud, the more room for waste.

Savvy stakeholders, especially those who already pay attention to expenses in other technology categories (mobility, telecom, Software as a Service), know that uncontrolled cloud computing will significantly reduce any return on investment. Just as with wireless or networking or other strategic IT spend categories, department heads must come together to craft a strategic approach to overseeing cloud computing deployments and expenses. The stakes are too high.

Consider the wider perspective: Between 2020 and 2021, spending on public infrastructure as a service (IaaS) and platform as a service (PaaS) soared 37%. In numbers, that totals a $60 billion increase.

Kelly Teal, Senior Research Analyst, Amalgam Insights

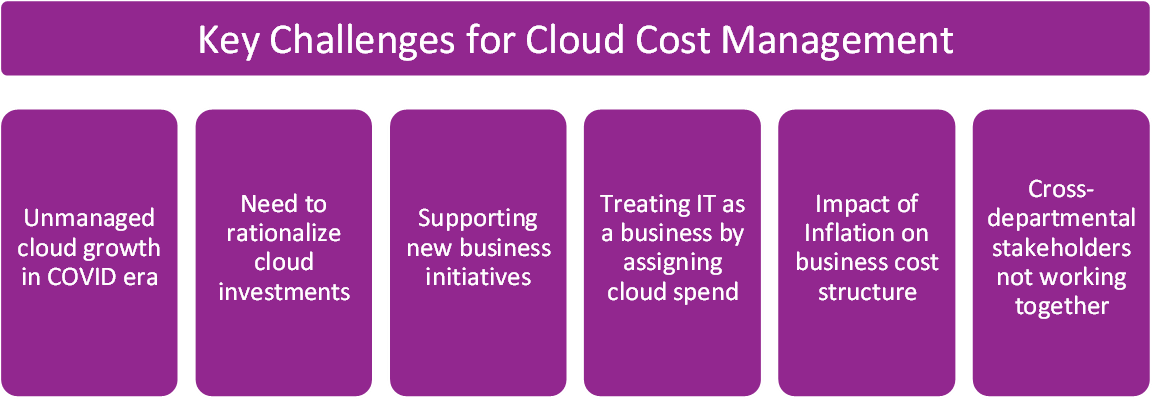

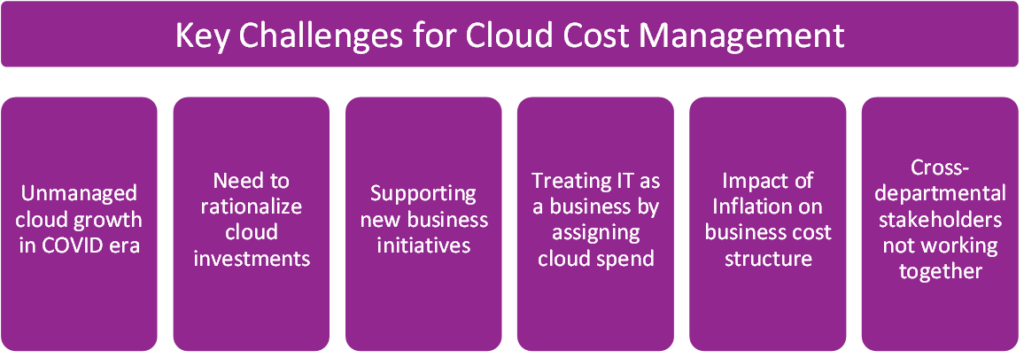

COVID-19, of course, served as the impetus for much of that growth. Anecdotally, cloud computing vendors have reported that the demand they expected to serve around 2030 hit a decade earlier because of the pandemic. As governments worldwide mandated lockdowns, organizations had to rush to support work-from-home setups for employees. Cloud computing delivered many of the capabilities businesses needed; IT teams scrambled, often cobbling together solutions that met staff needs but were not cost-effective. Leaders spent much of 2021 trying to rectify those issues, yet more cleanup remains to be done. Contractual obligations, employee preferences, and heavy lifting associated with a technology shift all can slow the process.

At the same time, organizations face new challenges in 2022. Inflation rose by 7% by the end of 2021, just in the United States, according to the Consumer Price Index. Everyone is paying more for the same products and services, and wages are not keeping pace. Revenue may not make up for the gap, either. This leaves executives and line-of-business leaders more aware of spending than perhaps ever. Cloud computing represents a major area ripe for attention.

Cloud computing also accelerates the ability to bring new ideas to market and execute on business opportunities. At a time when the attention and relationship economies require deeper and more data-driven understanding of customers, cloud computing allows access to the analytics, machine learning, and relevant connections that achieve that. Organizations need to translate new ideas into fully-fledged business units without investing millions of dollars in upfront cost on computing assets.

However, IT should not act alone when it comes to deciding how to manage cloud computing expenses just for the sake of getting the job done in a convenient way. Cloud computing, just like its wireless and telecom counterparts, impacts the entire organization. Therefore, the finance, IT, revenue, security, and governance departments all must be involved, on some level, in overseeing cloud computing investments. For example, executives in charge of budgeting need to understand cloud computing costs; IT must select and manage platforms and assign and monitor users and consumption; software development and IT architects need to tag and track resources as cloud services are spun up and down; and data experts have to ensure that the organization’s information within the various cloud resources stays in line with laws such as Europe’s General Data Protection Regulation (GDPR).

Cloud computing is complicated. Executives across the organization need a deeper understanding of the intricacies so they can work together to spend wisely while ensuring no critical aspect goes overlooked. Amalgam Insights is stepping in to guide organizations through these considerations with our upcoming Vendor SmartList, “Control Your Cloud: Why Organizations Need Cloud Cost Management Capabilities in 2022.”

Executives seeking to control cloud expenses need to read this report because it will provide expert analysis on the key cloud cost containment challenges of 2022 and the differentiated approaches to reduce and optimize cloud costs. The report also will features vendor profiles that cut through the hype and show why each vendor is different in a sector where marketing messages all seem to focus on the same starting points of reducing cost, providing financial visibility, and improving cross-departmental collaboration. This last issue emphasizes an important point: The profiles do not rank the providers that brief with Amalgam Insights. Rather, Amalgam Insights explores what makes each vendor different and offers guidance on why that vendor is currently chosen in a crowded marketplace. This level of detail gives organizations the knowledge to pinpoint which vendor(s) might best meet their needs for cloud computing cost management.

The following stakeholders all will need to read and act on the report: Chief Technology Officers, Chief Information Officers, Chief Financial Officers, “Shadow IT” managers in sales and marketing, DevOps Directors and Managers, IT Architects, Vice President/Director/Manager of IT Operations, Product Managers, IT Sourcing Directors and Managers, IT Procurement Directors and Managers, IT Service Providers and Resellers. Each of these roles is crucial to achieving cloud computing success throughout the organization.

“Control Your Cloud: Why Organizations Need Cloud Cost Management Capabilities in 2022” will publish in the second quarter of 2022.