Since the start of COVID-19 more than two years ago, cloud computing infrastructure and platform spend categories have collectively increased 48% per year. That makes the related costs both an outlier in IT and a key target for potential expense reduction, especially as a recession — caused by the pandemic — hovers on the horizon.

All in all, in 2022, global spending on cloud computing — including infrastructure and software — will total more than $350 billion, according to Amalgam Insights. As such, organizations require expert guidance for making the most of their cloud computing environments while, at the same time, trimming unnecessary outlay.

Cloud Computing By the Numbers

Amalgam Insights estimates that organizational investments in cloud computing infrastructure and platform services will continue to increase 25% per year for the rest of this decade. The reasons for shifting to cloud technologies mostly tie to the ongoing COVID-19 pandemic, and concurrent digital transformation and modernization projects that support workforce flexibility.

The reality of that momentum shows in the 48% annual growth of public IaaS and PaaS from 2019 to 2021, based on estimates from Gartner, IDC, Apps Run the World, and Amalgam Insights’ research that represents a $90 billion increase worldwide.

And a third of that $350 billion total is waste.

Understanding the IT Rule of 30

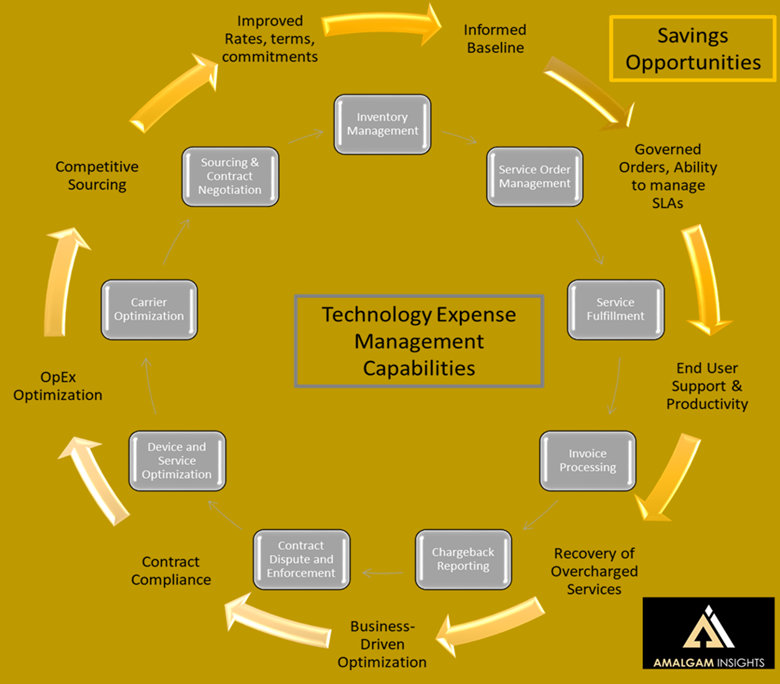

Amalgam Insights has done the math that demonstrates that unmanaged IT spend categories average 30% waste, due to the inherent lack of governance, sourcing immaturity, and lack of expense visibility. Given that public cloud computing constitutes a spend area covered by the IT Rule of 30, organizations are collectively spending billions of dollars unnecessarily. In the cloud computing world, waste often creeps up due to service duplication, and the unmanaged growth of production and sandbox resources. The combination leads to outsized cloud computing bills ripe for optimization and management.

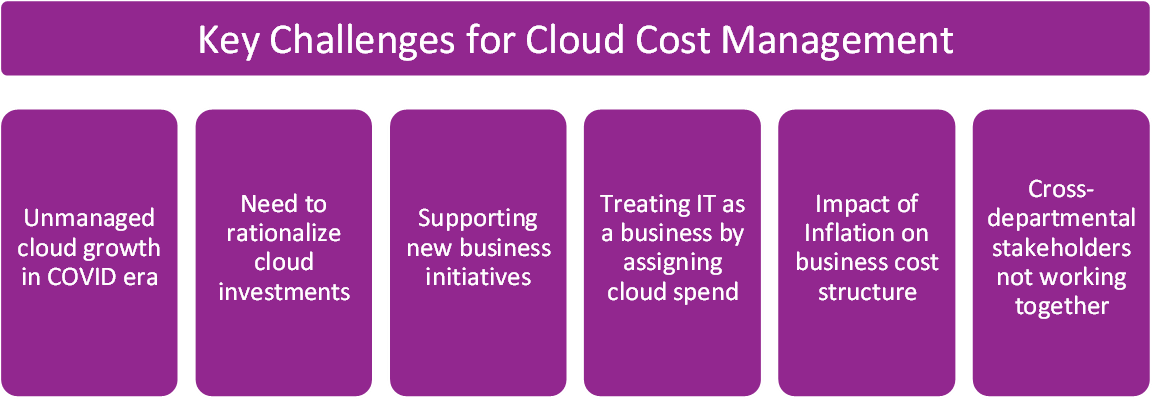

Deterrents to Good Cloud Computing Governance

Because cloud computing represents the fastest growing subcategory of technology spend in most businesses, this outlay requires strategic oversight from the finance, IT, revenue, security, and governance departments.

But consider some of the common barriers organizations face:

• Finance and line-of-business executives in charge of budgeting need to understand that cloud computing costs are nuanced and cannot simply be slashed in proportion to the budget as a whole;

• IT must choose and manage platforms, and assign and monitor users and consumption;

• Software development and IT architects need to tag and track resources as cloud computing services are spun up and down;

• Data experts have to ensure that the organization’s information within the various cloud resources stays in line with privacy laws such as Europe’s General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and the Personal Information Protection and Electronic Documents Act in Canada.

Finally, we discuss three other important realities that hamstring a cohesive and effective cloud computing management and optimization strategy.

Ch-ch-ch-Changes

First, cloud vendors tend to create new services rapidly with little to no prior notice — and they retain the right to change billing structures on an ad-hoc basis. For example, Amazon Web Services alone has 226 products across analytics, compute, containerization, database, developer tools, machine learning, networking, security, storage, and a variety of other technical capabilities. The vendor usually adds 20 or more new products every year.

Even if adjustments benefit end users, they can prove hard to track. That means organizations can have a hard time ensuring that even just a single vendor’s billed costs match actual consumption and contractual terms. Imagine what happens when an organization relies on multiple cloud providers.

Inconsistency

Along those lines, the second challenge lies in using the data delivered by the cloud providers themselves. While the information — which can comprise usage, expenses, taxes, permissions, and consumption by user for each product — is vital, Amalgam Insights’ big caveat is that cloud computing vendors do not usually maintain consistent detail. This makes defining services ownership and usage — especially across specific projects and employees — difficult. After that, the burden of accurate project and departmental tracking falls on how well the organization has set up internal tags and tracking — typically a hit-or-miss proposition.

Siloes

The third is that when organizations institute cloud computing management and optimization, they tend to do so through software and managed services specific to the various components of cloud computing — think items including infrastructure (e.g. virtualized desktops, containerized workloads), software/applications, storage, compute, and networking. Such a siloed approach contributes to ongoing lack of visibility and communication among decision-makers, and sets the stage for less-than-optimal stewardship of the cloud environment.

Overall, these financial, operational, and governance requirements create complexity that can quickly morph into a full-time job for a software developer, cloud architect, or data manager. And each of these professionals is likely being paid handsomely to help grow the company — not track inventories, bills, and service orders. (Learn more in our companion piece, “An Important Side Note on FinOps and Cloud Economics”)

Tackling the Cloud Computing Management and Optimization Problem

For the most part, organizations recognize the need to better

manage their cloud computing environments. The impetus to do so increases amid

the threat of a global recession. Amalgam Insights contends that organizations — especially those using hybrid clouds or multiple public clouds — can gain significant

value, even during a worldwide economic slowdown, by using third-party

management tools. These platforms (and in many instances, associated consulting

and managed services) offer the cleanest insight into the cloud environment

while simultaneously assuring the wisest spending and delivery of more

sophisticated services to corporate and external clients.

In Part 2 of this series, Amalgam Insights will discuss the reasons to turn to a third-party cloud computing management and optimization partner, versus trying to go it alone and/or rely on vendor-generated data.

Need More Guidance Now?

Check out Amalgam Insights’ new Vendor SmartList report, Control Your Cloud: Selecting Cloud Cost Management in the Face of Recession, available for purchase. If you want to discuss your Cloud Cost Management challenges, please feel free to schedule time with us.