Note: This piece was accurate as of the time it was written, but on August 11th, Zoom edited its Service Agreement to remove the most egregious claims around content ownership. Its current language is more focused on the limited license needed to deliver content and establishes that user content is owned by the user. Amalgam Insights considers the changes made as of August 11th to be more in-line both with industry standards and with enterprise compliance concerns.

On August 7, 2023, Zoom announced a change to its terms and conditions in response to language discovered in Zoom’s service agreement that gave Zoom nearly unlimited capability to collect data and an unlimited license to use this information going forward for any commercial use. In doing so, Zoom has brought up a variety of intellectual property and AI issues that are important for every software vendor, IT department, and software sourcing group to consider over the next 12-18 months.

Analyzing Zoom’s Service Agreement Language

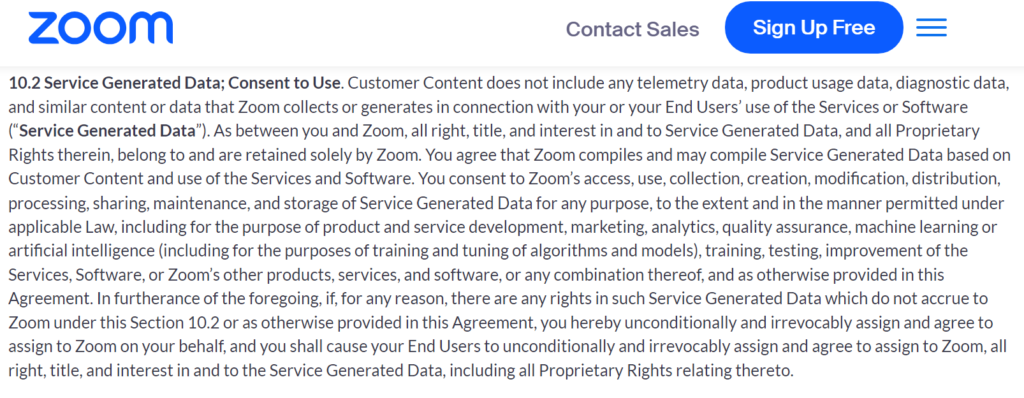

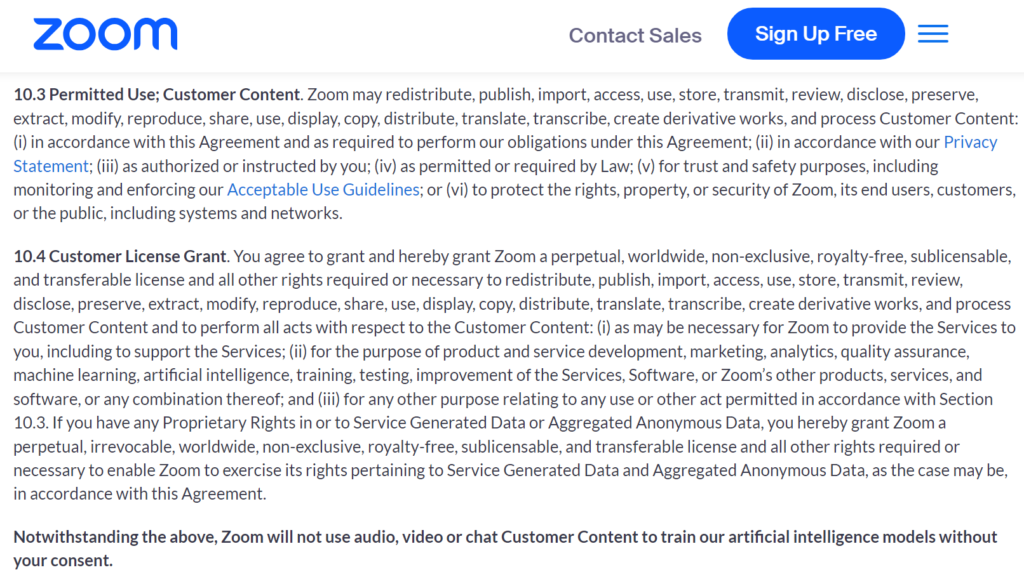

This discovery seems to have been a few months in the making as these changes seem to have initially been made back in March 2023 as it was launching some AI capabilities. Looking at each section, we can see that 10.2 and 10.3 focus on the usage of data.

Although this data usage may seem aggressive at first, one has to understand that Zoom‘s primary function is video conferencing, which requires moving both video and audio data across multiple servers to get from one point to another. This requires Zoom to have broad permission to transfer all data involved in a standard video, conference, or webinar, which includes all the data being used and all of the service data created. So, in this case, Amalgam Insights believes this access to data is not such a big deal as Zoom probably needed to update this language simply to support even basic augments, such as cleaning up audio or improving visual quality with any sort of artificial or machine learning capabilities.

However, in Amalgam, insights perspective, 10.4 is of much more aggressive set of terms. This change provides Zoom with a broad-ranging commercial license to any data used on Zoom‘s platform. This means that your face, your voice, and any trade, secrets, patents, or trademarks used on Zoom now become commercially usable by Zoom. Whether this was the intention or not, this section both sounds aggressive and crosses the line on the treatment that companies expect for their own data.

This is an extremely aggressive stance by most intellectual property standards. And it stands out as conflicting in comparison, to how data is positioned by Microsoft and Salesforce, enterprise application platform companies that aren’t exactly considered innocent or naïve in terms of running a business.

What went wrong here? Zoom is traditionally known as a company that is for the most part end user-centric. Zoom’s mission includes the goal, to “improve the quality and effectiveness of communications. We deliver happiness.” And Eric Yuan’s early stories about wanting to speak with loved ones remotely and refusing to do on-site meetings in promoting the power of remote meetings are part of the Zoom legend.

However, Zoom is also facing the challenge of meeting institutional shareholder demands to increase stock value. When Zoom’s stock rose in the pandemic, it reached such amazing heights that it led to extreme pressure for Zoom to figure out how to 5X or 10X their company revenue quickly. Knowing that the stock was in a bit of a bubble, Zoom initially tried to purchase Five9, a top-notch cloud contact center solution, but ran into problems during the acquisition process as the stock prices of each company ended up being too volatile to come to an agreement on both the value and price of the stock involved.

And I speculate that at this point Zoom is focused on bringing its stock back up to pandemic heights, a bubble that may honestly never be reached again. For Zoom, 2020 was a dot-com-like event, where its valuation wildly exceeded its revenue. And as other video conferencing, and event software solutions ended up quickly improving their products, Zoom’s core conferencing capabilities started to be seen as a somewhat commoditized capability.

Following the mission of the company would have meant looking more deeply at communications-based processes, collaboration, transcription, and perhaps even emoji and social media enhancement: all of the ways that we communicate with each other. But, the problem is that there is really only one play right now that can quickly leads to a doubling or tripling of stock price and that is AI. There’s no doubt that the amount of video and audio that Zoom processes on a daily basis can train a massive language model, as well as other machine learning models focused on re-creating and enhancing video and audio.

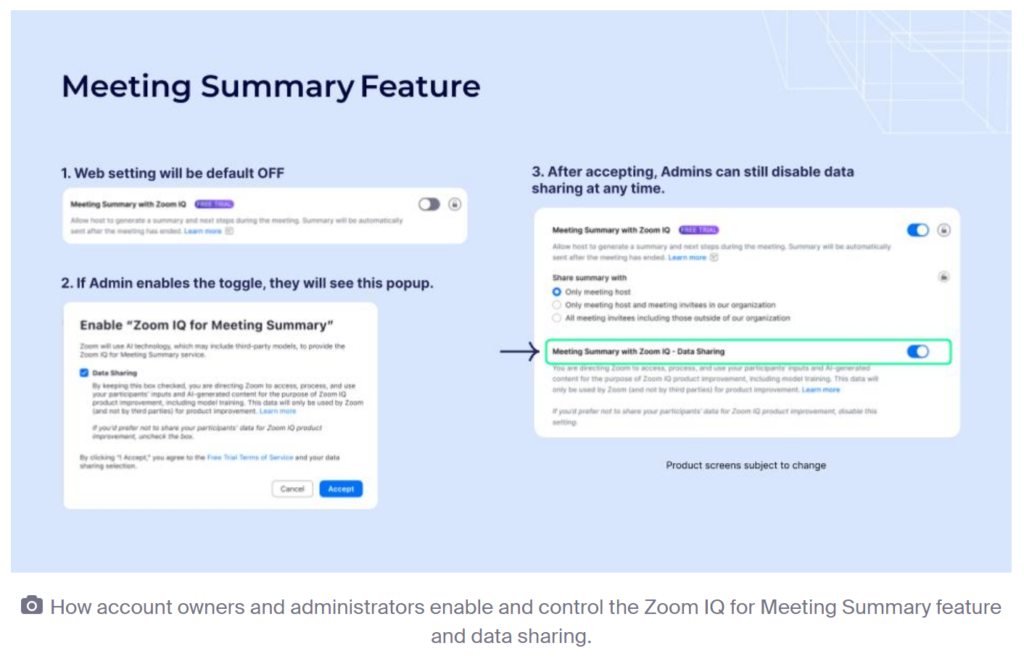

Positioned in a way where it was understood that Zoom would enhance current communicative capabilities, it could’ve been a very positive announcement for Zoom to talk about new AI capabilities. Zoom has taken initial steps to integrate AI into Zoom with Meeting Summary and Team Chat Compose products. But given the limited capabilities of these products, the licensing language used in the service agreement seems excessive.

The language used in section 10 of Zoom’s service agreement is very clear about maintaining the right to license and commercialized all aspects of any data collected by Zoom. And that statement has not been modified. Whether this is because of an overactive lawyer or Zoom’s future ambitions, or promises made to a board or institutional investors is beyond my pay grade and visibility. But I do know that that phrase is obviously not user-friendly, and Zoom is not providing visibility to those changes at the administrative level. The language and buttons used to support zooms, a model and commercialization efforts are very different on the administrative page compared to the language used in the service agreement.

Image from Zoom’s August 7th blog post

Understanding that legal language can take time to change, it makes sense to wait a few days to see if Zoom reverts to prior language or further modifies section 10 to represent a more user-friendly and client-friendly promise. And I think this language reflects a couple of issues that go far beyond Zoom.

First, service agreements for software companies in general, are often treated as an exercise in providing companies with maximum flexibility, while taking away basic rights from end users. This is not just a product management issue; this is an industry issue where this language and behavior is considered status quo both in the technology industry and in the legal profession. When companies like Alphabet and Meta, previously Facebook, were able to get away with the level of data collection associated with supporting each free user without facing governance or compliance consequences in most of the world, that set a standard for tech companies’ corporate counsel. Honestly, the language used in Zoom‘s current service agreement as of August 7, 2023 is not out of scope for many companies in the consumer world that provide social technologies.

The second issue is the overwhelming pressure that exists to be first or early to market in AI. The remarkable success of ChatGPT and other open AI-related models has shown that there is demand for AI that is either interesting or useful and can be easily used and accessed by the typical user or customer. This demand is especially high for any company that has a significant amount of text, data, audio, or video. The recent March 2023 announcement of Bloomberg GPT is only the starting point of what will be a wide variety of custom language, models and machine learning models that come to market over the next 12 to 18 months. Zoom obviously wants to be part of that discussion, and there are other companies, such as Microsoft, Adobe and Alphabet as well as noted start-ups like OpenAI that have done amazing AI work with audio and video already. Part of the reason that this stands out is that Zoom is one of the first companies to change its policies and aggressively seek a permanent commercial license associated with all user content and forcing and opt-out process that lacks auditability or documentation regarding how users can trust that their data is no longer being used to train models or support any other commercial activities Zoom may wish to pursue. But Amalgam Insights is absolutely sure that Zoom will not be the last company to do this by any means. This language and the response should also serve as both a warning and a lesson to all other companies, seeking to significantly change their service agreements to support AI projects.

What is next for Zoom?

From Amalgam Insights’ perspective, there are three potential directions that Zoom can pursue going forward.

One, do nothing or make minimal changes to the current policy. Consumer and social media-based technology policies have set a precedent for the level of data and licensing access in Zoom’s service agreement, but this level of customer data usage is considered extreme in most business software agreements. Will Zoom end up being a test case for pushing the boundaries for business data use? This seems unlikely given that Zoom has not traditionally been considered an aggressive company in pushing customer norms. Zoom does try to move fast and scale fast, but Zoom’s mistakes have typically been more due to incomplete processes rather than acts of commission and intentionally trying to push boundaries.

Two, rewrite parts of Section 10 that are intrusive from a licensing and commercial usage perspective. Amalgam Insights hopes that this is an opportunity for Zoom to lead from an end user licensing or service agreement perspective in making agreements more transparent and in using more exact legal language that feels cooperative instead of coercive. The legal approach of including all possible scenarios may be considered professionally competent, but the business optics are antagonistic.

Three, come out with an explicit enterprise version of technology that is not managed under these current rules set in section 10 so that data is not explicitly used for models and cannot easily be turned on through a simple toggle switch in the administration console. As my friend and data management analyst extraordinaire Tony Baer stated on LinkedIn (where you should be following him) “The solution for Zoom is to be more explicit: an enterprise version where data, no matter how anonymized, is not shared for Generative AI or any other Zoom commercial purpose whatsoever, and maybe a more general and/or freemium edition (which is how many consumers have already been roped in) where Zoom can do its Gen AI thing.”

Recommendations

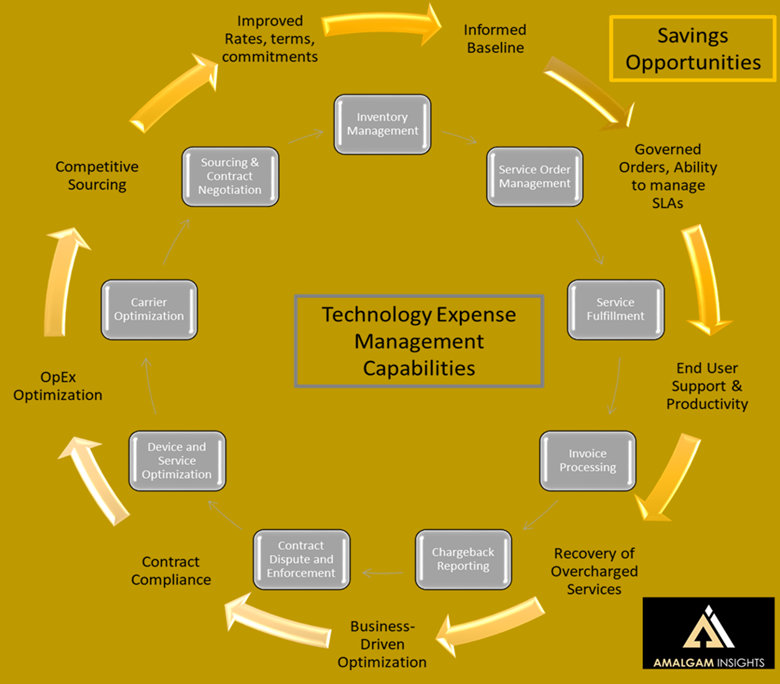

The first recommendation is actually aimed towards the CIO office, procurement office, and other software purchasers. Be aware that your software provider is going to pursue AI and will likely need to change terms and conditions associated with your account to do so. This is a challenge, as multinational enterprises now face the possibility of approaching or exceeding 1,000 apps and data sources under management and even businesses of 250 employees or less average one app per employee. There is a massive race towards aggregating data, building custom AI models, and commercializing the outputs as benchmarks, workflows, automation, and guidance. But Zoom is not a one-off situation and your organization isn’t going to escape the issues brought up in Zoom’s service agreement language just by moving to another provider. This is an endemic and market-wide challenge, far beyond what Zoom is experiencing.

The second recommendation: One solution to this problem may be for vendors to split their product into public consumer-facing products and private products from a EULA and terms and conditions perspective. This wouldn’t be the worst approach, and would maintain the consumer expectation of free services that are subsidized by data and access while giving businesses, the confidence that they are working with a solution that will protect their intellectual property from being accessed or recreated by a machine learning model. This also potentially allows for more transparency in legal language as this product split is considered. Tech lawyer Cathy Gellis, stated “There can be the lawyerly temptation to phrase them (terms of service) as broadly as possible to give you the most flexibility as you continue to develop your service. But the problem with trying to proactively obtain as many permissions as you can is that users may start to think you will actually use them and react to that possibility.” In 2023, software vendors should assume that corporate clients will be wary of any language that puts trade secrets, patents, trademarks, or personally identifiable information at risk. Any changes to terms of service or service agreements should be reviewed both from a buy-side and sell-side perspective. This may include bringing in procurement or specialized software purchasing teams to reflect the customer’s perspective.

The third recommendation goes back to the ethical AI work that Amalgam Insights did several years ago. AI must be conducted in context of the same culture and goals that are considered pervasive within the company. Any AI policy that goes significantly outside the culture, norms, and expectations of the company will stand out. And this can be a challenge, because AI has been treated as an experiment in many cases, rather than as a formalized, technical capability. As AI development and policy is shaped, this is a time when new products, governance, and documentation need to be tightly aligned to core business and mission principles. AI is a test of every company’s culture and purpose and this is a time when the corporate ability to execute on lofty qualitative ideals will be actively challenged.

Zoom’s misstep in aggressively pursuing rights and access to client data should not just be seen as a specific organizational misstep, but as part of a set of trends that are important for enterprise, IT, purchasing, and legal departments as well as all software and data source vendors seeking to pursue AI and further monetize deep digital assets. The next 12 to 18 months are going to be a wild time in the technology market as every software vendor pursues some sort of AI strategy, and there will be mountains of new legal language, technical capabilities, and compliance aspects to review.