On June 16, 2022, Vendr, a SaaS (Software-as-a-Service purchasing platform) announced a $150 million Series B round co-led by prior investor Craft Ventures and novel investor SoftBank Vision Fund 2 and joined by Sozo Ventures, F-Prime Capital, Sound Ventures, Tiger Global, and Y Combinator. The company states that this funding will drive platform enhancements.

Why this funding announcement matters

To fully contextualize this announcement, Amalgam Insights will dig into the context of the macroeconomic issues driving the importance of this announcement, the tactical importance of a SaaS purchasing solution in the Technology Lifecycle Management (TLM), and the nature of the investment compared to other historical funding announcements in the TLM space.

Macro Trends for Corporate Spend Reduction

First, this announcement comes at a time when the United States is facing inflation that approaches double-digits. The current 8.6% inflation rate in this country threatens to devour the average 8.19% net margin that publicly traded companies (excluding financial services) currently achieve. In addition, we are facing a global recessionary trend driven by COVID, supply chain issues, geopolitical strife including the occupation of Ukraine, strained Sino-US relations, inconsistent oil and gas policies, and an excess of money supply created over the past several years. In the face of these global challenges, it is prudent for companies to seek to reduce discretionary costs where it is possible and to shift those costs to strategic growth areas. Traditionally, recessions have been a time when strong companies invest in their core so that they can execute when the economy picks up again.

SaaS as a Strategic and Expanding Complex Spend Category

In this context, SaaS is a massive, but complex, opportunity to cut costs. Amalgam Insights estimates that the SaaS market has grown 25% per year in each of the last two years. Multiple studies show that enterprises that have reached the billion-dollar annual revenue threshold average over 300 apps directly purchased by the organization and over 900 apps running over their networks, either on in-office networks or on employee devices. The hundreds of apps here obviously equate to hundreds, possibly thousands, of accounts and bills that can be consolidated, negotiated, and potentially rationalized to concentrate spend on strategic vendors and gain purchasing power. It is not uncommon to find large enterprises using 20 or more different project management solutions, just to look at one SaaS subcategory.

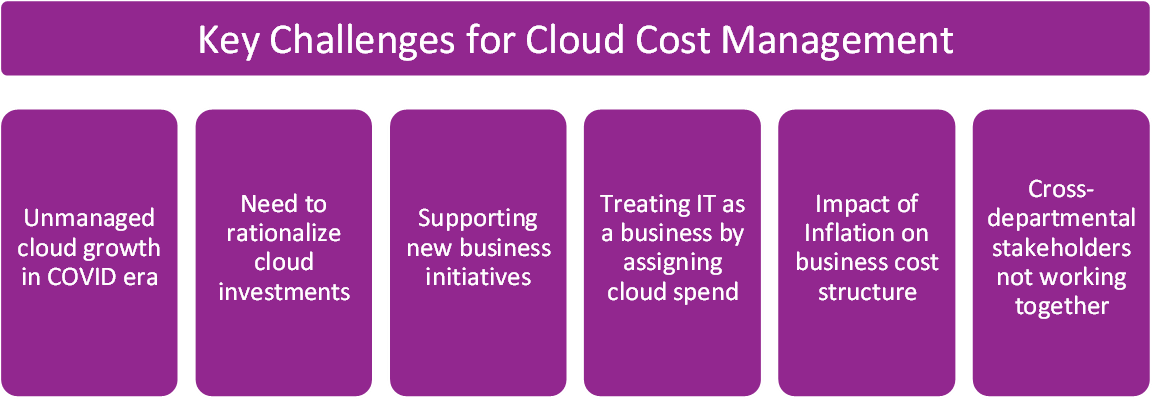

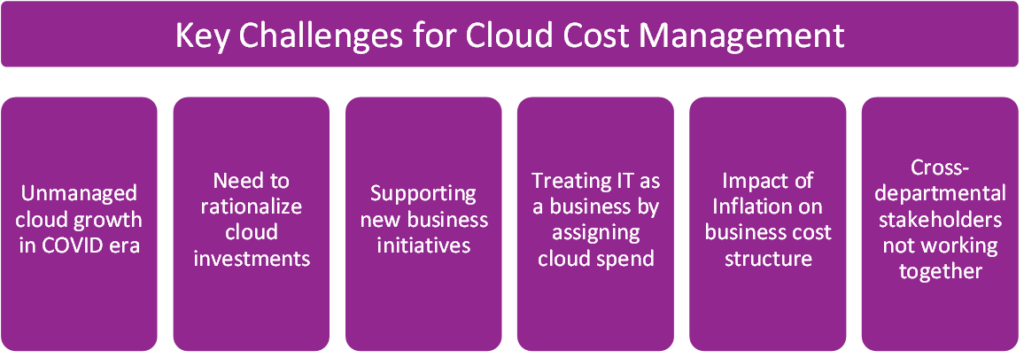

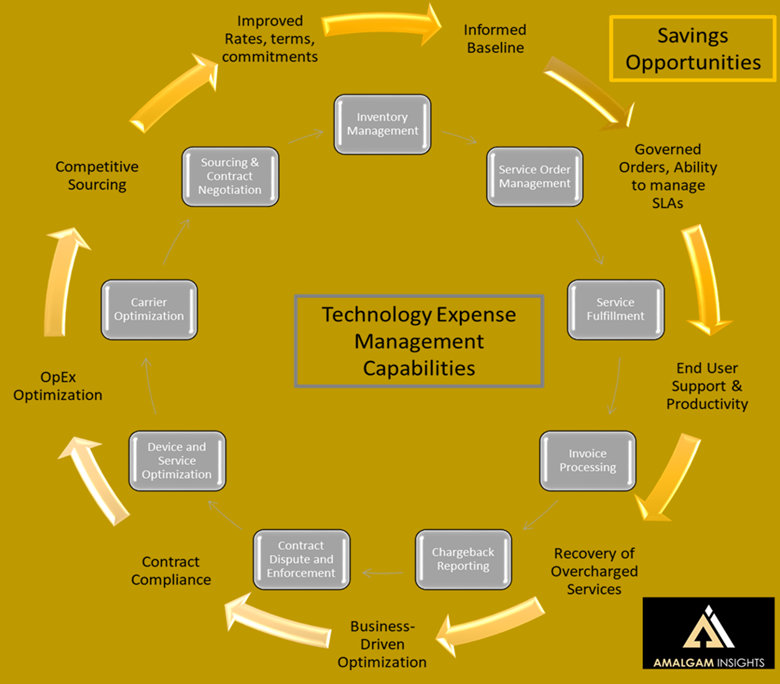

This rationalization is vital if enterprises are to take the IT Rule of 30 seriously. Amalgam Insights states that the IT Rule of 30 is that any unmanaged IT category averages a 30% opportunity to cut costs. But that 30% requires following the Technology Lifecycle to fully uncover opportunities to cut costs.

The majority of companies that Amalgam Insights speaks to in the IT expense role limit their diligence in IT spend to the right side of this lifecycle including timely bill payment, possibly cross-charging to relevant business entities and cost centers, and right-sizing expenses by finding duplicate or over-provisioned accounts. While this is necessary to execute on the IT Rule of 30, it is not sufficient. In the SaaS space, Amalgam Insights believes there is conservatively a $24 billion spend reduction opportunity globally based on improved SaaS purchasing and negotiations. At the micro level, this equates to a 2 million dollars for the average billion-dollar+ enterprise, with results varying widely based on SaaS adoption (as SaaS only makes up 30% of overall enterprise software spend globally), company size, and level of internal software contract knowledge.

Putting The Investment in Perspective

Amalgam Insights understands the scale of this business opportunity. Even so, this $150 million B round represents a massive round in the Technology Lifecycle Management space. Consider other large funding rounds in this space including:

Zylo’s 2019 $22.5 million B Round for SaaS Management

BetterCloud’s 2020 $75 million F Round for SaaS Management

Productiv’s 2021 $45 million C Round for SaaS Management

Beamy’s 2022 $9 million A Round for European SaaS Management

Torii’s 2022 $50 million B Round for SaaS Management

and looking further across the Technology Management spectrum

Cloudability’s 2016 $24 million B Round for IaaS Management (later acquired by Apptio)

CloudCheckr’s 2017 $50 million A Round for IaaS Management (later acquired by NetApp)

CloudHealth’s 2017 $46 million D Round for IaaS Management (later acquired by VMware)

MOBI’s 2015 $35 million investment round for Managed Mobility (later acquired by Tangoe)

I hasten to add here that more is not always better. But this range of funding rounds is meant to show the amount of investment that typically goes into solutions designed to manage technology expenses, inventory, and sourcing. At first glance, Vendr’s funding round may seem like just another funding announcement in the billions and trillions of dollars involved in the tech sector to those who do not cover this space closely. But as someone who has covered telecom, cloud, and SaaS expense management closely for the last 14 years, this round stands out as a massive investment in this space.

In addition, the investors involved in this round are top-tier including Craft Ventures, where founder and ex-Paypal founder David Sacks has been a proponent of Vendr, and the combination of Tiger Global and Softbank, which may be the two most aggressive funds on the planet in terms of placing big bets on the future. The quality of both smart money and aggressive money in this investment during a quasi-recessionary period speaks to the opportunity that exists here.

What to expect from this round?

The official word from Vendr so far is that this funding round is about data and platform. Vendr acquired SaaS cost and usage monitoring firm Blissfully in February 2022 to bring sourcing and expense management together and support the full lifecycle for SaaS. Amalgam Insights expects that some of these funds will be spent to better integrate Blissfully into Vendr’s operations. In addition, the contract information that Vendr has represents a massive data and analytics opportunity, but this will likely require some investment into non-standard document management, database, machine learning, and data science technologies to integrate documents, tactics, terms, and results. Whether this investment takes the form of a multi-modal database, graph database, sentiment analysis, custom modeling, process mining, process automation, or other technologies is yet to be seen, but the opportunity to gain visibility to the full SaaS lifecycle and optimize agreements continuously is massive not only from a cost perspective, but also a digital transformation perspective. The data, alone, represents an immediate opportunity to either productize the benchmarks or to provide guidance to clients with ongoing opportunities to align SaaS usage and acquisition trends with other key operational, revenue, and employee performance trends.

This part is editorializing, but Vendr has the opportunity to dig deeper into tech-driven process improvement compared to current automation platforms that focus on documenting and driving process, but have to abstract the technologies used to support the process. In the short term, Vendr has enough work to do in creating the first SaaS Lifecycle Management company that brings buying, expense, and operations management together. But with this level of funding, Vendr has the opportunity to go even further in aligning SaaS to business value not only from a cost-basis perspective, but from a top-line revenue contribution perspective. Needless to say, Amalgam Insights looks forward to seeing Vendr deliver on its vision for managing and supporting SaaS management at scale and to tracking the investments Vendr makes in its people, products, and data ecosystem.